This Future of TV Briefing covers the latest in streaming and TV for Digiday+ members and is distributed over email every Wednesday at 10 a.m. ET. More from the series →

This week’s Future of TV Briefing looks at why performance-minded, digital-leaning advertisers need help crossing over as traditional TV metrics subsume streaming.

Streaming the gap

Math is hard. But it’s made easier by the fact that it deals in a singular, universal language: numbers. At its root, streaming ad measurement is math. However, its math at the moment is less simple arithmetic than algebra.

Since streaming sits at the intersection of traditional TV and digital, individual advertisers may be more accustomed to traditional TV’s or digital’s measurement methodologies. In either case, they are having to account for various, erm, variables to arrive at their preferred metrics. And with streaming trending toward a more traditional TV-like measurement currency-based transaction system, performance-based, digital-leaning advertisers especially are having to figure out how to adapt, which was a hot topic during Digiday’s recent Programmatic Marketing Summit.

“As video and CTV become more dominant, it’s just starting to look like TV. You have to come up with not just a measurement but a currency. And actually, shit, they’re calling it that now, right?” an attendee said during one of the event’s closed-door town hall sessions.

The challenge for performance-based, digital-leaning advertisers in shifting to this currency-based system is that they’re accustomed to things like real-time measurement systems and last-click attribution models.

“What can be very surprising is how many especially digital-focused brands are still reliant on last-click attribution, which is such a flawed model, I know, but that’s something we see all the time. And you guys can probably guess how CTV performs in a last-click attribution model,” said Christine Schrader, vp of content and communications at Wpromote, during an on-stage session.

Getting advertisers to let go of their legacy measurement systems and attribution models is no easy feat, though. Just ask anyone in the traditional TV ad business.

But it is possible. In fact, there’s precedent.

More than a decade ago, when Facebook wasn’t yet Meta and was trying to attract brand advertisers from traditional media, it had to work out how to get them to see past the sticker shock of its ad impressions.

Because of Facebook’s granular targeting options compared to traditional TV’s broad age-and-demo-based options, its CPMs were higher. On an apples-to-apples basis, Facebook looked prohibitively expensive, even though traditional TV’s CPMs were lower, in part, due to the inherent waste of ads being shown to an entire audience, including those outside an advertiser’s target.

So Facebook pitched advertisers on what it called an “effective CPM,” meaning how much advertisers paid per thousand impressions but just for the impressions that reached the advertiser’s target audience. Given traditional TV’s inherent waste, its effective CPM could end up being much higher than Facebook’s, helping Facebook to make its case to advertisers. And obviously that worked, and it’s rare to hear Facebook talk up its effective CPMs anymore. Now they’re just CPMs.

The effective CPM was essentially a bridge metric, created to facilitate the translation between old and new metrics and methodologies. And the effective CPM hasn’t been exclusively a tool for digital platforms. The addressable TV ad market has used the effective CPM to justify the higher price of its targeted ads compared to traditional TV.

And now it seems the streaming ad market is in need of its own bridge metric(s) to help performance-based, digital-leaning advertisers, ahem, bridge the gap to the more traditional TV-like measurement system. At least, I floated that idea during one of DPMS’s town hall sessions, and the programmatic marketers in the room seemed interested.

“I think ‘effectives’ and ‘bridges’ is the only place to live. The challenge is it’s a unique application to each scenario,” said a second DPMS attendee. That is, an advertiser would need to determine its definition of effectiveness, be that a survey-based approach, a probabilistic model, etc., said the attendee. “How you calibrate that is based on your client’s level of comfort, and then you have to iterate from that or say, ‘This is the way, but it’s imperfect, and it needs to exist.’”

What we’ve heard

“The timing of this deadline, coinciding with the kick-off and wrap-up of Cannes, appears to be an arbitrary and publicity-seeking effort by The Trade Desk (TTD) at Yahoo’s expense, especially given the incredibly low amount of revenue this represents for both companies.”

— Yahoo spokesperson Erin Miller after The Trade Desk disabled access to Yahoo’s video inventory

Disney maintains its TV watch time lead

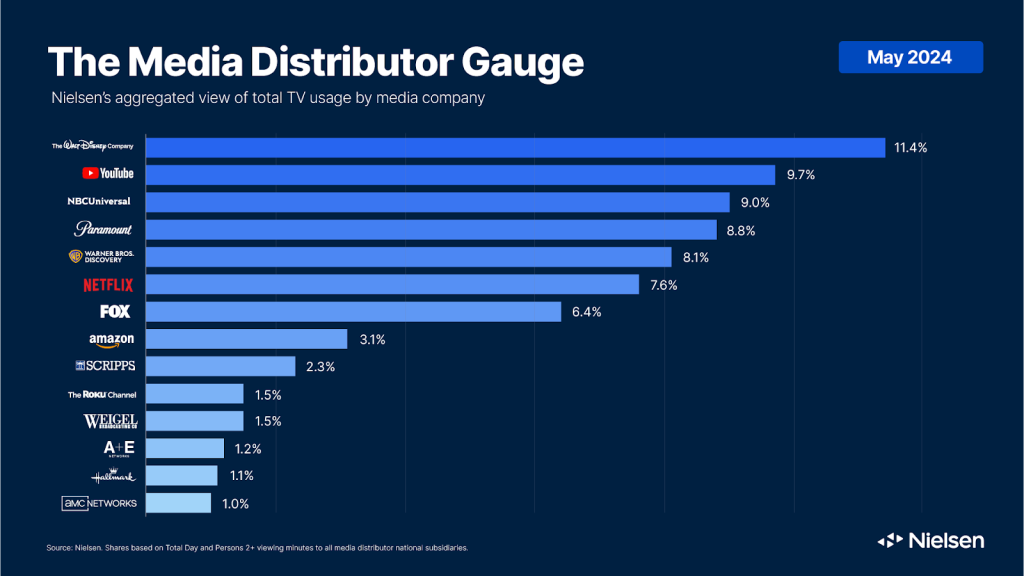

Disney+ may have fallen behind Fox’s Tubi when it comes to share of TV watch time in May 2024, but Disney overall — including ABC, ESPN and Hulu — held its position as the media company with the most watch time across traditional TV and streaming that month, according to Nielsen’s latest The Media Distributor Gauge report.

Of the companies listed, Fox notched the biggest watch time increase, a 0.3 percentage point bump from April thanks to watch time gains at Tubi and Fox News. And Roku’s The Roku Channel was the only one to change its ranking, going from No. 11 to No. 10.

Numbers to know

2.37 million: Number of estimated subscribers that U.S. pay-TV services — including streaming pay-TV services — lost in the first quarter of 2024.

48%: Percentage share of money-making creators who earned $15,000 or less last year.

$7.99: New monthly subscription price for Paramount+’s ad-supported tier.

250,000: Number of video podcasts that are being distributed on Spotify.

$70 million: How much BuzzFeed is asking companies to pay to acquire First We Feast, including its hit show “Hot Ones.”

What we’ve covered

The Trade Desk shuts advertisers’ access to Yahoo’s video content:

- The major DSP disabled Yahoo’s inventory because it doesn’t consider the inventory to be in-stream, as labeled by Yahoo.

- In 2022, IAB Tech Lab issued new guidelines for what should be considered in-stream video ad inventory vs. out-stream.

Read more about TTD vs. Yahoo here.

Why the Tribeca Film Festival embraced AI movies with OpenAI and Runway:

- The festival screened short films made using OpenAI’s Sora model and Runway ML’s AI tools.

- Festival organizers and filmmakers defended the use of generative AI as another creative tool.

Read more about Tribeca Film Festival’s AI embrace here.

Sugar23 pitches marketers on production in Cannes:

- The production and talent management shop recently announced a deal with Starbucks to produce original shows and movies.

- Brands have a spotty track record as producers, with Mattel as the best example in recent memory.

Read more about Sugar23’s Cannes pitch here.

Influencer marketing firm Captiv8 looks to grow social commerce with brand storefront offering:

- Creators can use Captiv8 to aggregate their commerce and curated products into one store.

- Captiv8 claims its creators prefer storefronts to one-off affiliate links.

Read more about Captiv8 here.

Omnicom’s Flywheel gets certified with TikTok Shop as it ties creators to sales results:

- Omnicom’s e-commerce specialist aims to help the agency’s clients use TikTok for e-commerce.

- Omnicom and TikTok announced a Creative Exchange deal in January.

Read more about Flywheel’s TikTok Shop certification here.

What we’re reading

Disney’s streaming ad undercut:

In this year’s upfront market, the media company is reducing Disney+’s ad rates by up to 15% in order to secure more money from advertisers and siphon spend away from competitors, according to Variety.

Netflix’s free foray:

To boost its ad business, the dominant subscription-based streamer has considered creating free versions of its service in Europe and Asia, but not the U.S., according to Bloomberg.

Streaming’s subscriber-profitability threshold:

Streaming executives believe a streaming service likely needs to have at least 200 million subscribers in order to be safely profitable, according to The New York Times.

Spulu’s streaming product plans:

Fine, we’ll call it by its official name, Venu Sports. The forthcoming Disney-Fox-Warner Bros. Discovery-owned sports streamer seems set to include an option for subscribers to record games and to stream multiple games simultaneously, according to Lowpass.

CTV’s SSP overload:

The CTV ad market is getting even more convoluted with CTV platforms and streaming services selling inventory through a multitude of supply-side platforms that may in turn resell that inventory and further drive up prices, according to AdExchanger.