![]()

Journalist

Posted:

- EOS has fallen by over 90% from its ATH

- The network is set to have its hard fork on 25 September

EOS recently released a long-awaited network upgrade ahead of its upcoming hard fork, marking its first major update in years. This upgrade introduces several new features aimed at enhancing the network’s functionality. However, despite the positive developments surrounding the upgrade and the upcoming hard fork, EOS has seen only a mild positive reaction in the market.

Also, EOS continues to rank outside the top 50 cryptocurrency assets by market capitalization.

EOS gets stable upgrade

According to an official announcement from the EOS Network Foundation, the network has just launched its Spring 1.0 upgrade, officially named Antelope Spring v1.0.0. This marks the most significant upgrade for EOS since its inception nearly seven years ago.

The release highlights that the upgrade will enhance the network’s performance, security, and scalability, making it better equipped to handle larger transaction volumes and improve overall network efficiency. These improvements are expected to make EOS more competitive and capable of supporting a broader range of decentralized applications (dApps).

With the upgrade in place, EOS is positioning itself to address key issues and pave the way for its upcoming hard fork. This can signal a potential turning point for the network as it seeks to regain momentum in the crypto space.

EOS sees minimal response

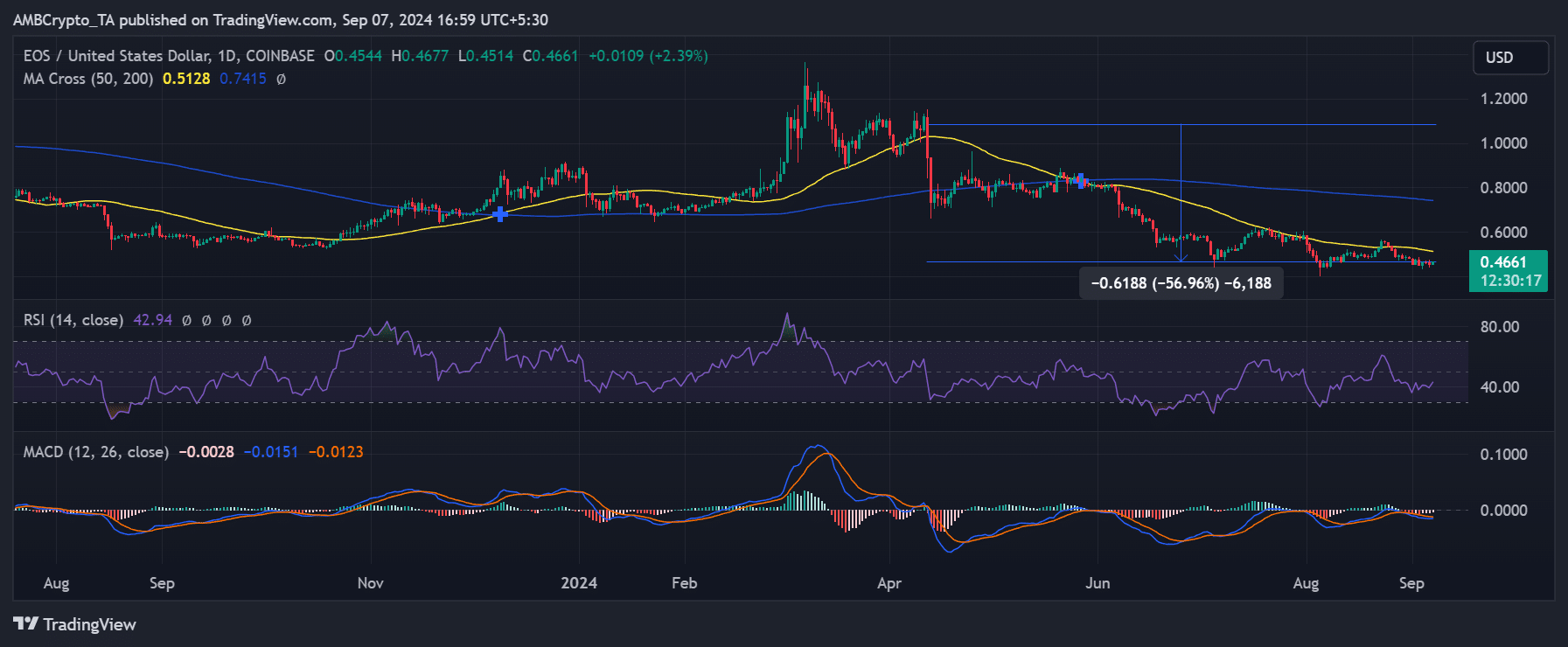

An analysis of EOS’s price trend revealed that it has been on a persistent downtrend over the past several months.

The short-moving average (yellow line) has doubled as a trend line, confirming the declining pattern. This yellow line acted as a consistent resistance level for EOS for nearly six months, preventing any sustained upwards movement.

Source: TradingView

At the time of writing, EOS was trading at around $0.466, following a modest hike of over 2%. However, since April, when the yellow line flipped from support to resistance, EOS has declined by over 50%, as indicated by the price range indicator.

Further analysis of the Moving Average Convergence Divergence (MACD) revealed that the histogram and signal lines were below zero, indicating a strong bearish trend. The placement of these indicators suggested that despite the recent slight uptick, EOS remains in a bearish phase.

And, the asset faces challenges in overcoming resistance and reversing its downward momentum.

How it compares with other crypto assets

According to data from CoinMarketCap, EOS currently ranks as the 70th largest cryptocurrency by market capitalization. At press time, EOS had a market capitalization of approximately $706 million. EOS has seen a significant decline from its all-time high of $22.71, representing a 98% drop from its peak value.

This sharp decline is a sign of EOS’s struggles in maintaining its position in the cryptocurrency market.

TVL sees short-term hike

Finally, an analysis from DeFiLlama indicated that EOS’s Total Value Locked (TVL) declined significantly over the years. The last three days were different, however, with figures for the same climbing from $115 million to $119 million.

– Is your portfolio green? Check out the EOS Profit Calculator

And yet, despite this modest hike, the overall trend showed no major activity or growth on the network. Simply put, there’s no telling if and when the altcoin’s long-term decline will ever reverse itself.