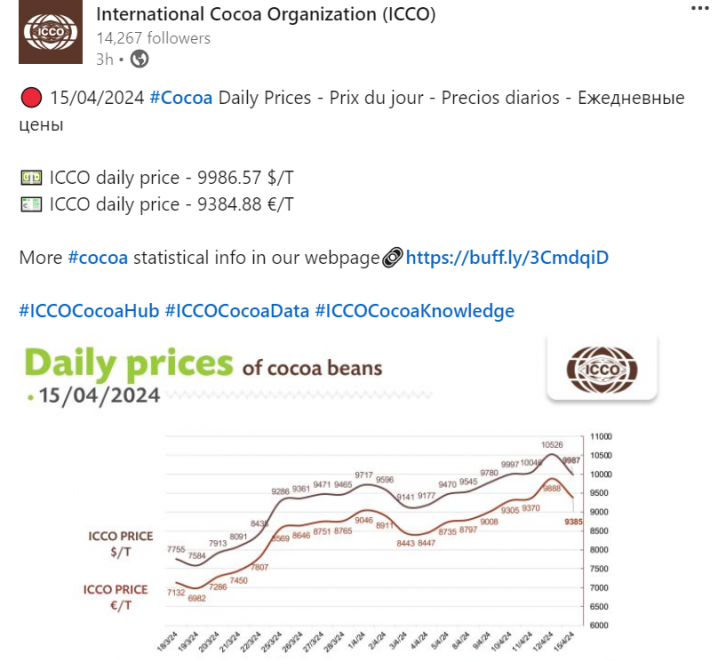

Concern that global cocoa supplies will continue to shrink in the coming months is pushing prices to new record highs. Citi Research analysts predict that volatility in cocoa markets could see New York futures rise further to $12,500 a ton in the next three months.

Prices in New York have gained for seven straight sessions, the longest streak since early February. Harvests in the West African growing region have been severely affected by dreadful weather and crop disease.

Bloomberg reported Monday that cocoa arrivals to ports in Cote d’Ivoire (the world’s largest cocoa producer) have reached 1.31 million tons so far this season, down 30% from a year earlier.

Bankruptcies

The Citi analysts wrote that elevated prices are also raising the risk of bankruptcies for traders and buyers over the next six to 12 months.

Barchart.com reports that due to limited supplies, global cocoa grinders are paying up in the cash market to secure cocoa supplies this year due to growing concerns that West African cocoa suppliers may default on supply contracts.

Bloomberg also reported that the Ghana Cocoa Board is negotiating with significant cocoa traders to postpone the delivery of at least 150,000 MT to 250,000 MT of cocoa until next season due to a lack of beans.

As ConfectioneryNews has reported, cocoa prices have rallied sharply since the beginning of the year, driven by the worst supply shortage in 40 years.

Monday’s government data from Cote d’Ivoire showed that Ivory Coast farmers shipped 1.31 MMT of cocoa to ports from October 1 to April 14, down by 30% from the same time last year.

Third annual cocoa deficit

A third annual global cocoa deficit is expected to extend into 2023-24 since current production is insufficient to meet demand.

Also, cocoa prices are seeing support from the current El Nino weather event after an El Nino event in 2016 caused a drought that fuelled a rally in cocoa prices to a 12-year high, according to barchart.com.