When cultivated meat and seafood start-ups are deciding which species to recreate with cells, they often go after premium varieties and cuts. That way, when the product enters the market, it’s likely to have a better chance of achieving price parity.

But this is not Sea2Cell’s approach. The Israeli start-up wants to instead reduce the high costs associated with cultivated protein production – in its case, seafood – and is targeting affordable fish species to prove it.

“We chose fish with high-quality protein content that was reasonably priced,” explained Sea2Cell co-founder and CEO Orna Harel. The species selected include one freshwater fish, the rainbow trout, and two marine: gilthead seabream and seabass.

“They’re not the high-end premium bluefin tuna, but they’re fish that people like”.

Overcoming the ‘growth factor problem’ in-house

Sea2Cell is laser-focused on reducing costs in cultivated seafood production. The start-up is pulling several levers to achieve this, but a big one is addressing the ‘growth factors issue’.

Growth factors are important components of cell culture media, which is used to grow cells so that in the right environment they can proliferate and grow. But growth factors – which act as signalling molecules between cells – are expensive, sometimes prohibitively so. When a product finally comes to market, it’s likely to carry a higher price tag to recuperate these costs.

“It’s definitely one of the priciest ingredients in the whole operation,” explained Harel. Cultivated protein start-ups are approaching the problem in various ways, including by sourcing growth media from suppliers producing at scale.

But Sea2Cell is hesitant to be dependent on growth factor manufacturers. Instead, it wants to have complete control in-house.

“Our cells are able to secrete the growth factors themselves,” Orna revealed. “We’re focusing on the most expensive growth factors, FGF2 [fibroblast growth factor family] and TGFβ [transforming growth factor-beta], and we are also using fish growth factors.”

Although not a completely closed loop system, in essence the cells produce the growth factors, and then consume them. According to Sea2Cell’s calculations, cost weight can be reduced by up to 80%.

Cost-efficiencies from cell proliferation and differentiation

Other efficiencies come from the start-up’s proprietary cell lines, which are ‘immortalised’ – meaning they can be used continuously, without the need to acquire new cells from the animal.

It’s also essential that these cells proliferate quickly – doubling within at least a 36-hour period – to again reduce time and therefore cost. Sea2Cell boasts a cell doubling time of closer to 24-30 hours. “If the cells take a full week to double, you’ve accomplished nothing,” explained Harel.

Sea2Cell’s 24-30-hour cell doubling timeframe is particularly impressive given it’s working with fish, which proliferate at cooler temperatures compared to land mammals. This makes sense, given that Sea2Cell is focusing on species that in the wild grow in cold or temperate water. But while lower temperature requirements can slow down growth in a bioreactor, it has the added advantage of reducing heating costs.

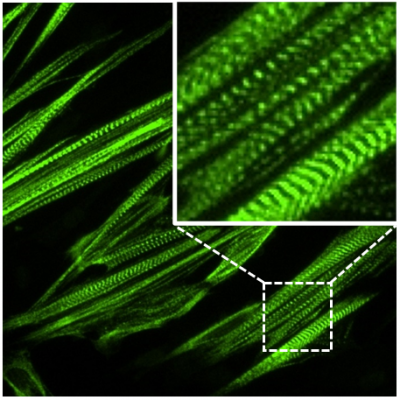

Another way fish flesh differs from mammalian meat is in its makeup: a fillet of fish is predominantly muscle (whereas a cut of steak combines meat with fat and other components). Isolating cell lines with the capacity to differentiate to muscle is not an easy task, explained Harel, but we were successful in doing it.

“Moreover, our cells maintain their ability to differentiate into myotubes over advanced passages (>100) meaning we have control over the proliferation and differentiation processes.”

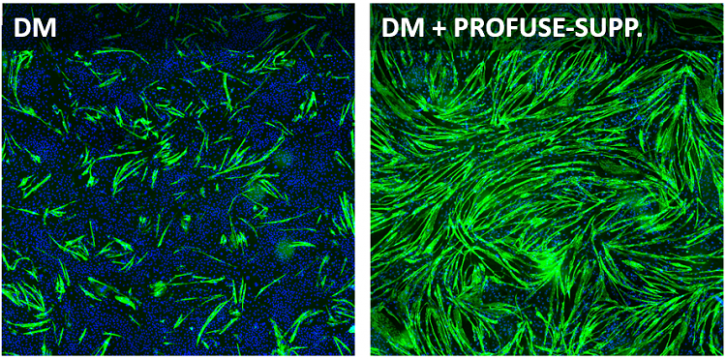

Sea2Cell is now working with fellow Israeli start-up Profuse Technology to help speed up this process. Profuse makes media supplements to encourage

differentiation for muscle growth. Early experiments with the supplement have yielded ‘amazing’ results, revealed the CEO. “The cells differentiate into mature myotubes in a few short days.”

Taking a hybrid approach, at least in the short-term

Sea2Cell has already developed initial prototypes blending cell-based ingredients with plant-based ingredients. The result offers ‘very good’ texture, we’re told.

Developing cell- and plant-based hybrids is the plan for initial market entry. The hybrid approach ‘makes sense’, according to Harel. Not only are hybrids less expensive than 100% cultivated meat products, but from a technical perspective, the hybrid model helps get cultivated protein products on the market sooner. No 100% cultivated meat or seafood products have yet been developed and sold.

“The sooner we see hybrid products on the market, the easier it will be for the next generation of products – containing more cell-based and less plant-based – to come onto the scene.”

As to where these initial hybrids will enter the market, Sea2Cell has the US on its radar. Singapore is often an attractive option for initial market entry, but the start-up has yet to make a ‘conclusive decision’ on that. The biggest, most attractive markets are likely the US and EU.

“In China, India and Japan – where fish and seafood are a relatively large part of the daily diet – consumer acceptance may be higher. So we will probably go there as well.”

Sea2Cell’s next steps in challenging investment period

The start-up had just graduated from the Israeli foodtech incubator Fresh Start and recently secured a second grant from the Israel Innovation Authority.

Although funding looks promising for Sea2Cell, the same cannot be said for the sector as a whole. Amid an unstable economic environment – fuelled by sociopolitical concerns and high inflation – investors have been less willing to part with money today than in the heyday of 2021.

But from an investor standpoint, the need for more sustainable proteins is not going away, according to Noga Sela Shalev, CEO of Fresh Start. This is where ‘food tech 2.0’ comes in. “Sea2Cell is a late bloomer in a sense, but what they’re doing is a good indication of the companies we’re looking for right now,” she told this publication.

To Shalev, Sea2Cell represents the ‘next generation’ of cellular agriculture companies – ones that tackle the key bottlenecks facing the industry, such as cost and scale. “Within the alternative protein space, we are looking much more at enablers and ‘clog openers’ which have the potential to make real changes in the field.”